Introduction

The Banking and Monetary business is going through quite a few challenges and operational inefficiencies over the previous few years, together with prolonged buyer onboarding processes, cumbersome Know Your Buyer (KYC) compliance, and excessive operational prices. These points have been exacerbated by the rising expectations of consumers for sooner, safer, and dependable providers in an more and more digital panorama.

To stay aggressive in a saturated market, particularly with the rise of digital banking, monetary establishments should adapt and innovate. Luckily, these challenges may be addressed by automation, notably by leveraging Robotic Course of Automation (RPA). RPA can streamline and optimize numerous banking operations, successfully lowering prices and bettering effectivity. AutomationEdge offers RPA-based options particularly designed to automate banking processes, serving to organizations improve their service supply and buyer expertise.

What’s RPA in Banking?

RPA in banking business may be leveraged to automate a number of time-consuming, repetitive processes like account opening, KYC course of, buyer providers, and plenty of others. Utilizing RPA in banking operations not solely streamlines the method effectivity but additionally allows banking organizations to be sure that value is decreased and the method is executed at an environment friendly time. In response to studies, RPA in banking sector is anticipated to achieve $1.12 billion by 2025. Additionally, by leveraging AI expertise along side RPA, the banking business can implement automation within the complicated decision-making banking course of like fraud detection, and anti-money laundering.

Why RPA is Necessary in Banking?

Financial institution staff usually deal with huge quantities of buyer information, and guide processes are inherently susceptible to errors. The intensive information extraction and guide processing concerned in banking operations can result in important inaccuracies, which might have critical penalties. For example, a single error in a crucial banking course of could end in instances of theft, fraud, or cash laundering.

As a substitute of counting on people to course of information manually, RPA can streamline these operations. For instance, validating buyer data from two totally different methods can take seconds with bots, versus minutes when completed manually. This effectivity not solely reduces the chance of errors but additionally accelerates the general course of.Introducing bots for such guide duties can result in processing value reductions of 30% to 70%. Furthermore, by automating a number of processes inside banks, staff may be freed as much as deal with extra crucial and strategic duties that require human intervention and decision-making.

Instance: Take into account the account opening course of at a financial institution. Historically, this entails accumulating buyer data, verifying paperwork, and getting into information into numerous methods. With RPA, a bot can routinely extract information from buyer types, cross-verify it with official paperwork, and enter the data into the financial institution’s methods. This not solely hastens the account opening course of but additionally considerably reduces the chance of errors, enhancing buyer satisfaction and belief within the banking establishment.

High 13 RPA Use Circumstances in Banking

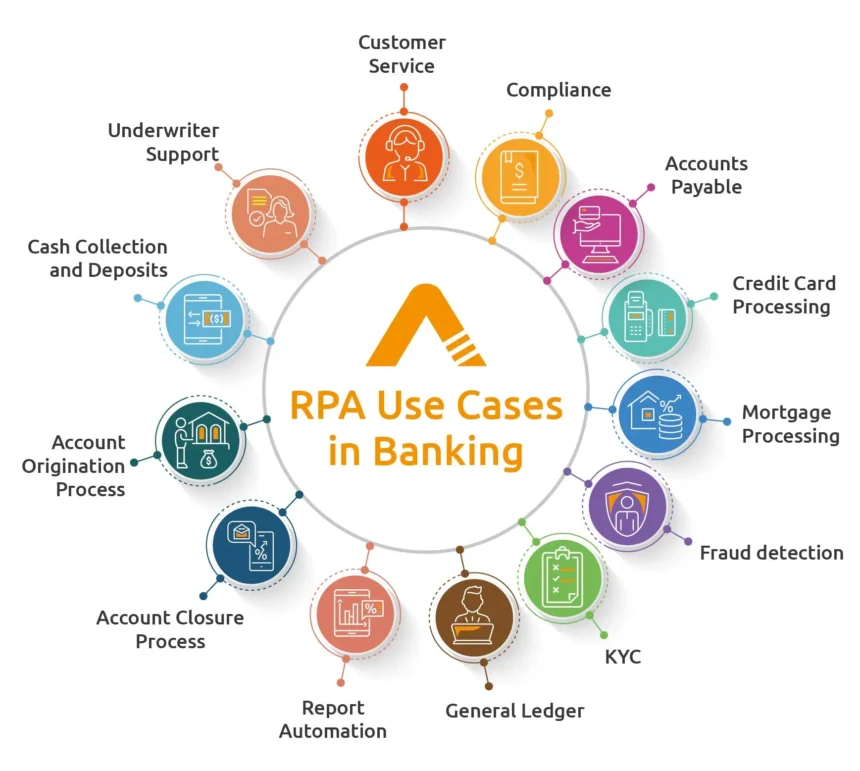

RPA has a plethora of various functions within the BFSI section to release the manpower to work on extra crucial duties. A few of these processes embody:

-

Buyer Service

Banks take care of a number of queries daily starting from account data to utility standing to steadiness data. It turns into troublesome for banks to reply to queries with a low turnaround time.

Over 80% of consumers who’ve used chatbots for product inquiries within the final 12 months wouldn’t need to use them once more—and 46% stated that they’d choose to make use of branches (Deloitte).

RPA can automate such rule-based processes to reply to queries in real-time and scale back turnaround time to seconds, liberating up human sources for extra crucial duties With the assistance of synthetic intelligence, RPA also can resolve queries that want decision-making. By utilizing NLP, Chatbot Automation allows bots to grasp the pure language of chatting with prospects and reply like people.

-

Compliance

Banking being the middle of the financial system is carefully ruled and desires to stick to many compliances. In response to an Accenture survey in 2016, 73% of respondents believed that RPA generally is a key enabler in compliance. RPA will increase productiveness with 24/7 availability and the best accuracy bettering the standard of the compliance course of.