Within the insurance coverage business’s technological battlefield, AI-powered Robotic Course of Automation (RPA) represents a crucial innovation, but stays shrouded in misconceptions. Staggering business information reveals that insurers lose roughly $30 billion yearly to inefficient processes, with guide claims dealing with consuming as much as 50% of operational prices.

These persistent Robotic Course of Automation myths not solely impede technological adoption however instantly translate to substantial monetary and operational losses. This text systematically deconstructs 5 prevalent AI and RPA misconceptions, showcasing the potential that may revolutionize insurance coverage effectivity and buyer expertise.

Fantasy 1: AI and RPA will exchange human employees totally

One of the pervasive RPA myths about AI in insurance coverage will utterly eradicate human jobs within the insurance coverage sector. The fact is much extra nuanced and collaborative. Quite than alternative, AI-powered RPA in insurance coverage are designed to enhance human capabilities, dealing with repetitive, time-consuming duties whereas liberating up insurance coverage professionals to deal with extra complicated, strategic actions.

As an example, claims processing, which historically entails in depth guide information entry and verification, could be considerably streamlined by means of Robotic Course of Automation. This permits claims adjusters to focus on extra intricate instances requiring human judgment, empathy, and complicated decision-making. The know-how acts as a robust assistant, not a alternative, enhancing total operational effectivity and worker productiveness.

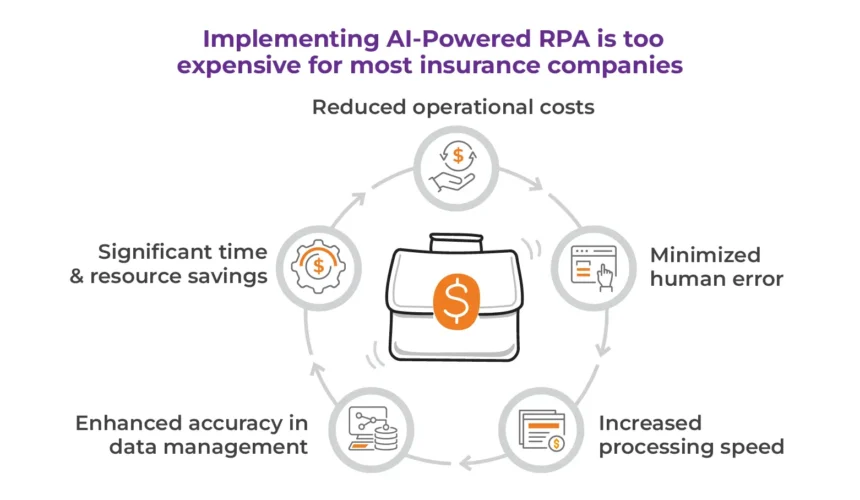

Fantasy 2: Implementing AI-Powered RPA is just too costly for many insurance coverage firms

Price considerations typically deter insurance coverage firms from embracing AI and RPA applied sciences. Nevertheless, the long-term return on funding tells a unique story. Whereas preliminary implementation may require upfront funding, the following advantages embrace:

- Lowered operational prices

- Minimized human error

- Elevated processing velocity

- Enhanced accuracy in information administration

- Vital time and useful resource financial savings

Fashionable AI-powered RPA in insurance coverage options have gotten more and more scalable and reasonably priced, with many suppliers providing versatile pricing fashions that may accommodate organizations of varied sizes. The price of not adopting these applied sciences typically outweighs the funding, as opponents leveraging AI and RPA achieve vital aggressive benefits.

Fantasy 3: AI and RPA are solely appropriate for big insurance coverage enterprises

AI-powered RPA (AI and RPA myths debunked) isn’t unique to massive insurance coverage firms. Small and medium-sized insurers can equally profit from these applied sciences. Scalable options now exist that may be tailor-made to particular organizational wants and budgets.

Smaller insurance coverage corporations can leverage RPA for:

- Automated coverage underwriting

- Streamlined claims processing

- Environment friendly buyer communication

- Clever information extraction

- Compliance monitoring

The secret is choosing the suitable answer that aligns with the group’s particular necessities and progress trajectory.