Stephanie Music, previously on the company improvement and ventures workforce at Coinbase, was usually annoyed by the quantity of due diligence duties she and her workforce needed to full each day.

“Analysts burn the midnight oil working tons of of hours doing the work that no person needs to do,” Music informed TechCrunch in an electronic mail interview. “On the similar time, funds are deploying much less capital and on the lookout for methods to make their groups extra environment friendly whereas decreasing working prices.”

Impressed to discover a higher means, Music teamed up with Brian Fernandez and Anand Chaturvedi, two ex-Coinbase colleagues, to launch Dili (to not be confused by the capital of East Timor), a platform that makes an attempt to automate key funding due diligence and portfolio administration steps for personal fairness and VC corporations utilizing AI.

Dili, a Y Combinator graduate, has raised $3.6 million in enterprise funding so far from backers together with Allianz Strategic Investments, Insurgent Fund, Singularity Capital, Corenest, Decacorn, Pioneer Fund, NVO Capital, Amino Capital, Rocketship VC, Hi2 Ventures, Gaingels and Hyper Ventures.

“[AI] impacts all components of an funding fund, from analysts to companions and back-office capabilities,” Music mentioned. “Funding professionals at funds are on the lookout for a differentiated edge on decision-making, and might now use their wealth of knowledge to mix their understanding of the cope with the way it matches into the funds … Dili has a novel alternative to emerge as an answer for funds in a harsh macro surroundings.”

Music’s not incorrect about funds on the lookout for an edge — or any new promising methods to mitigate investing threat, for that matter. VCs reportedly have $311 billion in unspent money, and final 12 months raised the bottom whole — $67 billion — in seven years as they grew more and more cautious about early-stage ventures.

Dili isn’t the primary to use AI to the due diligence course of. Gartner predicts that by 2025, greater than 75% of VC and early-stage investor govt opinions can be knowledgeable utilizing AI and information analytics.

A number of startups and incumbents are already tapping AI to pour by way of monetary paperwork and copious quantities of knowledge to craft market comparisons and studies — together with Wokelo (whose clients are personal fairness and VC funds, like Dili’s), Ansarada, AlphaSense and Thomson Reuters (by way of its Clear Opposed Media unit).

However Music insists that Dili makes use of “first-of-its-kind” expertise.

“[We can] ship very excessive accuracy on particular duties like pulling monetary metrics from massive unstructured paperwork,” she added. “We’ve constructed customized indexing and retrieval pipelines tuned for particular paperwork to offer [our AI] fashions with top quality context.”

Dili leverages GenAI, particularly massive languages fashions alongside the strains of OpenAI’s ChatGPT, to streamline investor workflows.

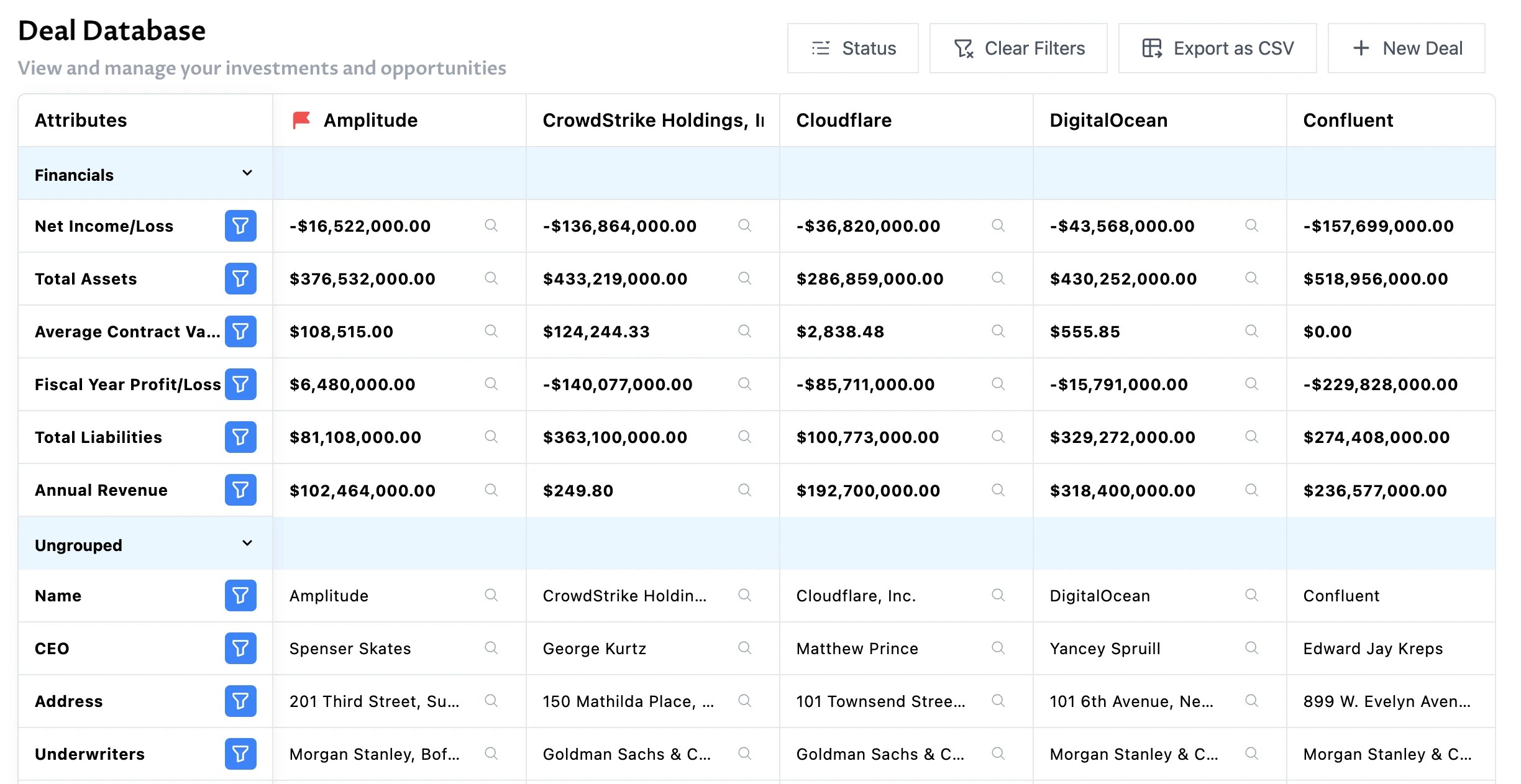

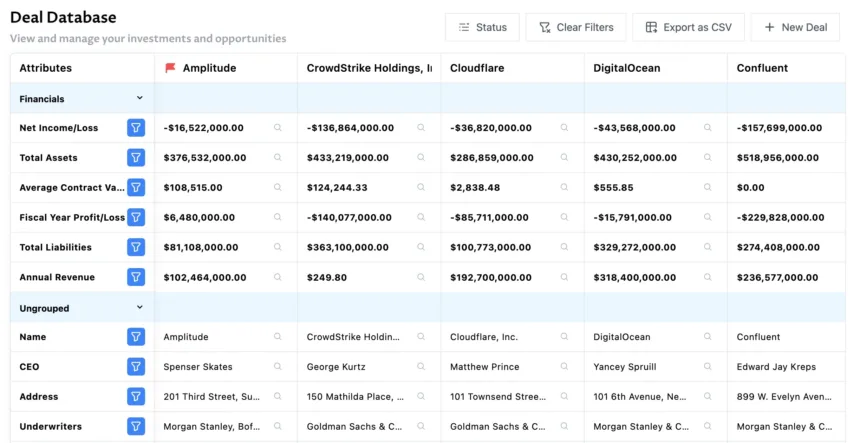

The platform first catalogs a fund’s historic monetary information and funding selections in a information base, after which applies the aforementioned fashions to automate duties akin to parsing databases of personal firm information, dealing with due diligence request lists and digging for little-known figures throughout the net.

Dili lately added help for automated comparable evaluation and trade benchmarking on a agency’s backlog of offers. As soon as funds add their deal information, they’ll evaluate historic and present funding alternatives in a single place.

“Think about with the ability to get an electronic mail with a brand new funding alternative or portfolio firm replace and immediately having a platform produce AI-generated deal crimson flags, aggressive evaluation, trade benchmarking and a preliminary abstract or memo leveraging your fund’s historic investing patterns,” Music mentioned.

The query is, can Dili’s AI — or any AI actually — be trusted in relation to managing a portfolio?

Picture Credit: Dili

AI isn’t essentially recognized for sticking to details, in any case. Quick Firm tested ChatGPT’s capacity to sum up articles and located that the mannequin had an inclination to get stuff incorrect, depart items out and outright invent particulars not talked about within the articles it summarized. It’s not powerful to think about how this would possibly turn out to be an actual downside in due diligence work, the place accuracy is paramount.

AI also can convey prejudices into the decisioning course of. In an experiment conducted by Harvard Enterprise Overview a number of years in the past, an algorithm educated to make startup funding suggestions was discovered to select white entrepreneurs moderately than entrepreneurs of colour and most well-liked investing in startups with male founders. That’s as a result of the general public information the algorithm was educated on mirrored the truth that fewer ladies and founders from underrepresented teams are usually disadvantaged within the funding course of — and in the end increase much less enterprise capital.

Then there’s the truth that some corporations won’t be comfy operating their personal, delicate information by way of a third-party mannequin.

To try to allay all these fears, Music mentioned that Dili is constant to fine-tune its fashions — lots of that are open supply — to cut back situations of hallucination and enhance general accuracy. She additionally confused that personal buyer information isn’t used to coach Dili’s fashions and that Dili plans to supply a means for funds to create their very own fashions educated on proprietary, offline fund information.

“Whereas hedge funds and public markets have invested closely in tech, personal market information has loads of untapped potential that Dili may unlock for corporations,” Music mentioned.

Dili ran an preliminary pilot final 12 months with 400 analysts and customers throughout several types of funds and banks. However because the startup expands its workforce and provides new capabilities, it’s angling to broaden into new functions — in the end towards turning into an “end-to-end” answer for investor due diligence and portfolio administration, Music says.

“Finally we consider this core expertise we’re constructing will be utilized to all components of the asset allocation course of,” she added.

Your article helped me a lot, is there any more related content? Thanks!