It is time to have fun the unbelievable ladies main the best way in AI! Nominate your inspiring leaders for VentureBeat’s Girls in AI Awards immediately earlier than June 18. Study Extra

Fixing the widening cybersecurity insurance coverage hole that drives companies away from buying or renewing insurance policies wants to start out with danger assessments primarily based on AI-driven real-time insights.

Cyber insurers are centered on serving to purchasers cut back the chance of a breach by regularly enhancing and augmenting cybersecurity methods. Actual-time danger assessments, underwriting enhancements, streamlining claims processing, and resilience planning all must be improved with AI delivering strong features to every.

“It’s lowering claims prices, which reduces insurance coverage premiums. We may give better-preferred pricing and higher protection by making certain they’ve good endpoint detection and response (EDR) in place. And that’s the hope to make it extra accessible for these smaller organizations and simply enhance consciousness total. No person desires to have incidents,” Anthony Dagostino, International Chief Cyber Underwriting Officer for Business Traces at AXA XL, informed VentureBeat in a current interview.

The present state of cyber insurance coverage

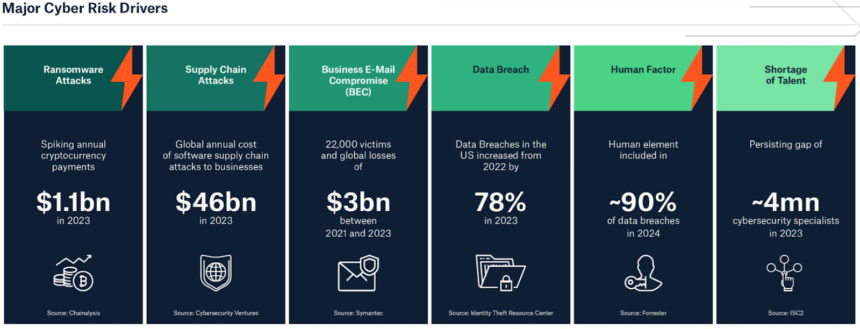

Ransomware, social engineering, phishing, and privileged entry credential assaults enhance premiums, making cyber insurance coverage unaffordable for a lot of companies. Ransomware assaults have been the first driver of cyber insurance coverage claims in early 2024, adopted by provide chain assaults and enterprise e-mail compromise (BEC) assaults. BEC assaults doubled in 2023, based on Verizon. Provide chain assaults proceed to extend, with twice as many occurring in 2023 in comparison with the earlier three years mixed. Software program provide chain value companies $46 billion in 2023.

Supply: Munich RE, Cyber Insurance Risks and Trends 2024

“Cyber insurance coverage is typically thought-about as a discretionary insurance coverage buy. It’s not required like employees’ comp within the states or property. So it’s both you’ve gotten a contract that’s requiring it you had an incident, and you realize that you simply want it, or certainly one of your opponents had an incident and you realize that you simply most likely want it,” Dagostino informed VentureBeat.

An business ripe for AI-driven enhancements

Practically all organizations battle to afford cyber insurance coverage as a consequence of rising premiums, with small- and medium companies (SMBs) being notably impacted. A couple of in 4 or 28% of SMBs surveyed, had been denied protection. In the event that they’re granted a coverage, SMBs usually tend to face important protection exclusions and require a number of claims.

Total, 67% of organizations stated their premiums had elevated between 50 to 100% after they utilized for or renewed their insurance policies final yr. All respondents to a current survey had new exclusions of their insurance policies, with some attack-related bills not lined.

Organizations are sometimes pressured to make trade-offs between buying cyber insurance coverage or including extra functions and providers to defend in opposition to assaults. “We work with clients to estimate these return on funding {dollars} and cents on the place they need to actually focus their power to make them safer,” Ann Irvine, Chief Information Scientist and Vice President of Product Administration at Resilience Insurance coverage informed VentureBeat. “This permits us to assist them resolve whether or not to put money into new instruments or enhance the administration of current ones.”

“The extra we perceive the instruments a buyer has deployed, how they’ve them deployed, the extra successfully we are able to repeatedly have interaction with them to make sure they’re mitigating their cyber danger through the coverage interval,” Irvine stated.

Cyber insurers are additionally seeking to AI to scale back the time and prices of real-time danger assessments that may value between $10,000 to $50,000 per assessment and take between 4 to 6 weeks to finish. AI can be streamlining the underwriting course of, lowering the standard workflow from weeks to days enhancing effectivity by as much as 70%. Conventional claims processing prices an insurer a mean of $15,000 per declare as a consequence of handbook dealing with, which may take as much as six months.

AI-based methods are chopping declare processing instances by over 80%. At-Bay, Corvus Insurance, Cowbell Cyber, Paladin Cyber and Resilience Insurance are offering AI-based options to assist streamline cyber insurance coverage.

CrowdStrike’s platform technique for enhancing Insurability

CrowdStrike’s launch of Falcon for Insurability defines a brand new period in how AI and LLMs are revolutionizing cyber insurance coverage. The brand new program is designed to provide cyber insurers the flexibleness they should present their purchasers and prospects with AI-native cyber safety utilizing the CrowdStrike Falcon cybersecurity platform at most popular charges. Daniel Bernard, chief enterprise officer at CrowdStrike, informed VentureBeat throughout a current interview that he predicts the discount in premiums might be within the 10 to 30% vary.

“This initiative permits large swaths of the market that have been ineligible for cyber insurance coverage to grow to be eligible. For these with Falcon, it turns into more cost effective to acquire the cyber insurance coverage they need and wish. Insurers can now quantify danger in methods they couldn’t earlier than, making smarter underwriting selections,” Bernard informed VentureBeat.

In accordance with IDC, organizations can detect 96% more threats in half the time in comparison with different distributors and conduct investigations 66% quicker with the Falcon platform. CrowdStrike’s purpose in providing Falcon for Insurability is to allow insurers, together with Ascot Group, AXA XL, Beazley Insurance coverage, Berkley Cyber Danger Options, Coalition and Resilience, to scale back underwriting danger figuring out their insured purchasers have a market-tested AI platform that may proceed to scale and ship hardened cyber resilience.

“I feel what we’re discovering now could be we convey these kind of partnerships collectively. It’s lowering claims prices which reduces insurance coverage premiums. We may give better-preferred pricing and higher protection by making certain they’ve good EDR in place. And that’s the hope to make it extra accessible for these smaller organizations and simply enhance consciousness total. No person desires to have incidents,” Dagostino stated.

Getting AI proper in cyber insurance coverage wants to start out with folks

It’s grow to be desk stakes to have human-in-the-middle AI workflows and architectures in cybersecurity, and that’s permeating cyber insurance coverage as properly. CrowdStrikes’ Managed Detection and Response (MDR) service is an instance of why human-in-the-middle is important. “Our AI-powered defenses, mixed with human experience, create an infinite loop the place all the things improves repeatedly. That is why cyber insurers are keen to affix us,” Bernard informed VentureBeat.

Irvine at Resilience agrees.”We take a extremely structured method to eliciting data from specialists. We have now very type of, properly, now we have workouts for calibrating specialists to assist them suppose probabilistically. Then we ask them very focused questions that may be the place their responses can instantly be used as information to affect our fashions,” Irvine stated.

“One of many issues about cyber insurance coverage that makes it so difficult as an business that’s completely different from each different type of insurance coverage now we have there may be the actuarial calculation,” Elia Zaitsev, CTO at CrowdStrike, informed VentureBeat.

Zaitsev continued, “So the explanation that conventional insurance coverage works is you may socialize the chance, proper? And also you don’t have all of the dangers firing without delay. But when you consider how cyber insurance coverage works, take into consideration issues like WannaCry and NotPetya, the place you’ve gotten extra of a world systematic difficulty. If everybody will get hit with the identical ransomware without delay, the potential for that type of destroys the actuarial map of cyber insurance coverage.”

Figuring out predictive assault paths is essential

Conventional insurance coverage fashions that socialize danger and canopy remoted incidents don’t work for cyber insurance coverage. What’s wanted are superior AI and enormous language mannequin (LLM) applied sciences that assist determine and anticipate potential routes attackers would possibly take to use vulnerabilities inside a corporation’s infrastructure. Zaitsev informed VentureBeat that predictive assault paths are a sport changer for cyber insurers as a result of they supply proactive reasonably than reactive cyber protection.

Predictive assault paths present the real-time insights wanted to scale back danger and the chance of an assault. Decreasing danger helps maintain premiums inexpensive and insurance policies possible for a broader base of purchasers. In addition they convey higher stability to cyber insurer by lowering the potential of a widespread danger of simultaneous, large-scale cyber occasions.

Falcon for Insurability takes on these challenges, capitalizing on the corporate’s a few years of expertise utilizing AI to assist cease breaches. Zaitsev informed VentureBeat. “We’re going to decrease your charges quite a bit when you’re utilizing know-how like CrowdStrike as a result of in any other case, the systematic danger makes it very tough for us to write down insurance policies which can be, frankly, inexpensive by the typical firm.”

Making cyber insurance coverage extra accessible

Organizations can spend months going by the applying course of to get cyber insurance coverage, solely to be rejected with no clarification. A standard imaginative and prescient all distributors have is to take away the boundaries in entrance of firms which were rejected for insurance coverage previously. Figuring out which instruments, apps and platforms their clients want to scale back the chance of a breach is the purpose.

VentureBeat believes extra cybersecurity platform distributors will emulate Falcon for Insurability, on the lookout for the win/win of lowering the chance of a breach that can drive down premium prices whereas growing market share throughout SMBs, mid-tier and enterprise clients served by channels and shared with cyber insurers.

Source link