Excessive rates of interest and monetary pressures make it extra vital than ever for finance groups to have a greater deal with on their money circulate, and a number of other startups are hoping to assist.

Two-year-old Israeli startup Panax is one, and it simply raised a $10 million Sequence A spherical of funding led by Team8, with participation from TLV Companions.

Startups have had some luck going after the CFO stack by streamlining processes and releasing up time to work on strategic duties. SVB’s collapse created tailwinds for the money administration class, which incorporates gamers resembling Embat, Kyriba, Assertion and Vesto.

In contrast to a few of these, Panax is targeted on midsize and enormous corporations in conventional industries resembling manufacturing, logistics and actual property. Whereas they want greater than startups do, they don’t all the time have the kind of giant treasury departments that legacy options cater to.

Goal apart, Panax additionally hopes to distinguish itself in its providing, and never simply by together with funding accounts and credit score traces in its purview.

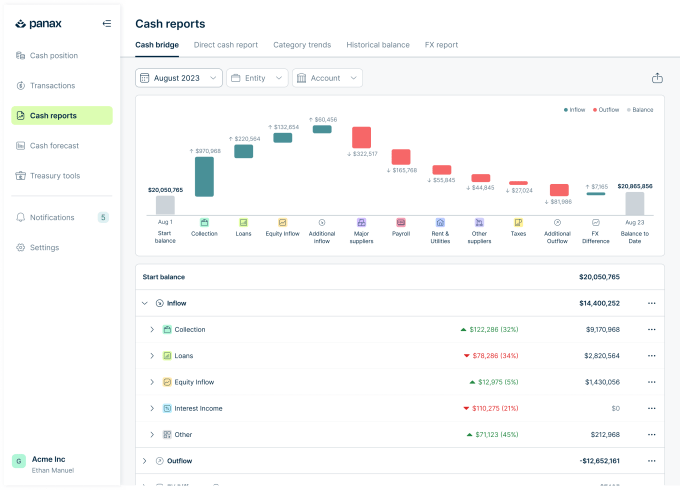

Whereas visualizing money circulate is useful, Panax desires to go additional than offering a dashboard, Panax CEO Noam Mills advised TechCrunch. She thinks serving to their purchasers requires “utilizing knowledge to know what’s actually vital, influencing these choices and serving to them handle [their treasury].”

This worth proposition appears to resonate with Panax’s early adopters, which embrace corporations resembling public beauty-focused firm Oddity, and for which money administration automation is a money and time saver.

Bringing its whole funding to $15.5 million following a $5.5 million seed spherical led by TLV Companions, this new spherical will assist Panax scale its go-to-market method and construct a extra strong AI and knowledge crew now that it has sufficient knowledge for this, Mills mentioned.

AI already performs an vital function at Panax: It helps the startup make sense of all of the monetary knowledge it places collectively, but in addition determine insights and forecast money circulate. For Mills, surfacing motion objects is the place AI can actually assist. “Oftentimes there’s no formal treasury division […] so we see AI as an awesome enabler to be proactive and lift the suitable flags for the consumer.”

Picture Credit: Panax

The purchasers Panax goes after are corporations with complicated treasury administration wants; sometimes, they function in a number of areas in currencies. International trade is one facet Panax might help optimize, and this might drive further for the corporate in addition to its SaaS mannequin, which is priced based mostly on the complexity of every consumer’s operations.

There are lots of stakeholders hoping to get a share from serving to corporations optimize their money circulate. As an illustration, they might apply for loans and request working capital or credit score traces from their banking app or from their accounting software program interface. However Panax has a card to play as a one-stop treasury administration dashboard that integrates suggestions and projections.

Panax’s objective, Mills mentioned, is that finance groups gained’t should go anyplace else to execute choices they need to make. “[That] if we carry them the insights, they’ll transfer additional cash into curiosity bearing accounts. Embedding that performance inside our platform is one thing that we see as actually tightly linked to our price proposition, and people are additionally issues that we’re creating throughout many alternative use instances with cash actions.”

Mills’ understanding of those wants comes from her expertise in non-public fairness, which she shares with chief enterprise officer and co-founder Niv Yaar. However her private background is kind of distinctive: Earlier than her roles in PE and company finance, she was an Olympic fencer for Israel, and gained a number of titles in her house nation.

Requested what her athlete previous and CEO function have in frequent, she highlighted comparable psychological necessities, resembling persistence and the power to cope with uncertainty. However fencing is a person sport, when working an organization “is extra like a crew sport.”

Following its Sequence A spherical, Panax will increase its NYC workplace and Yaar will transfer there, however its R&D will stay in Israel. So will Panax CTO and third co-founder, Sefi Itzkovich, who labored on machine studying at Fb after the corporate the place he beforehand rose as much as CTO, Otonomo, went public through a SPAC.

“There’s competitors for expertise in all places [but] the deep roots we’ve got within the R&D group in Israel by our CTO and the founding crew provides us considerably of a bonus competing for expertise,” Mills mentioned.

Mills expects that community results may even play a task in New York Metropolis, the place Team8 has an workplace. However she and her co-founders additionally picked town due to the extra overlap with Israel’s time zone in comparison with the Bay Space, and due to its relevance for fintech. “The middle for that’s extra in New York and the East Coast,” Mills mentioned.