There’s one thing of a pattern round legacy software program corporations and their hovering valuations: Corporations based in dinosaur instances are on a tear, evidenced this week with SAP‘s shares topping $200 for the primary time.

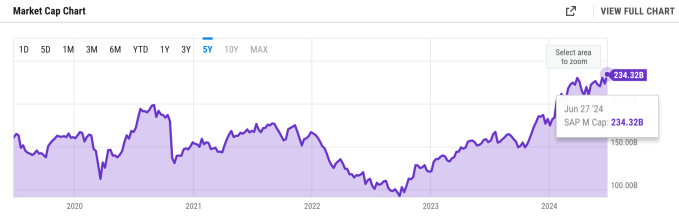

Based in 1972, SAP’s valuation at the moment sits at an all-time excessive of $234 billion. The Germany-based enterprise software program supplier was valued at $92 billion two years in the past, and $156 billion 12 months again, which means its market cap has grown greater than 50% previously 12 months alone.

Market valuations shouldn’t be conflated with firm well being, but it surely’s a helpful indicator of how an organization is doing — whether or not that’s by means of precise monetary efficiency or significant strikes it’s making to shift with the instances.

Outdated SAP

CEO Christian Klein has overseen SAP’s turnaround since 2020, specializing in serving to prospects transition to the cloud whereas placing helpful partnerships with hyperscalers such as Google and Nvidia alongside the way in which.

SAP’s fast rise can partly be attributed to this transition from an old-school license mannequin, with its Q1 2024 report revealing year-on-year cloud income progress of 24%, a determine it stated it expects to rise further in the next 12 months attributable to its “cloud backlog” earnings within the pipeline. Injecting “business AI” throughout its cloud suite can be taking part in an element on this trajectory.

Experiences emerged final 12 months that its on-premises prospects had become disgruntled with how SAP was placing its new technology into its cloud products only. However slightly than pandering, SAP’s doubling down on its push to carry them to the cloud, offering its on-prem customers reductions to make the transition — an AI carrot on a cloud stick, if you’ll.

Funding administration firm Ave Maria World Fairness Fund recently highlighted SAP as one in all its high three performers in Q1 2024, noting SAP’s transition “from a perpetual license mannequin to a SaaS mannequin” will create a bigger whole addressable market (TAM) and higher margins.

And it’s such efforts which might be driving the fortunes of SAP and comparable legacy software program corporations, based on Gartner chief forecaster John-David Lovelock.

“There are a number of tailwinds aiding progress — preferences for cloud over on-premises methods, upgrades and growth necessities,” Lovelock instructed TechCrunch. “However the main impact is solely digital enterprise transformation efforts that began in 2021 are ongoing.”

Hist-Oracle

And what about Oracle, the U.S. database and cloud infrastructure firm based in 1977? Oracle is valued at greater than $385 billion as of this week, 20% up on final 12 months, although this determine was at virtually $400 billion a few weeks again — far and away its highest ever valuation.

The explanations for this are roughly akin to that of SAP: “AI-fueled cloud growth,” the results of a protracted transition away from an on-premises mannequin.

Notably, Oracle’s fiscal 2024 Q3 earnings noticed the corporate move a key milestone, with its whole cloud income — that’s SaaS (software-as-a-service) plus IaaS (infrastructure-as-a-service) — surpassing its whole license assist income for the primary time.

“Now we have crossed over,” Oracle CEO Safra Catz said on the earnings call.

At its Q4 earnings, Oracle reported modest income progress of three% — however this determine elevated to twenty% for cloud-specific income. And extra is to come back, says Catz, projecting double-digit cloud income progress within the coming monetary 12 months. This has been aided by partnerships with the likes of Microsoft, Google, and generative AI darling OpenAI, that are in search of all of the cloud infrastructure they will get — OpenAI plans to make use of Oracle’s cloud to coach ChatGPT.

“In Q3 and This autumn, Oracle signed the biggest gross sales contracts in our historical past — pushed by huge demand for coaching AI massive language fashions within the Oracle Cloud,” Catz stated.

As with SAP, Oracle additionally recently inked a deal with Nvidia to assist governments and enterprises run “AI factories” regionally utilizing Oracle’s distributed computing infrastructure.

It’s not all a rosy outlook, although: One in all Oracle’s flagship prospects, TikTok, is going through a ban within the U.S., with Oracle warning this week that this might have an effect on its revenues sooner or later.

Huge Blue eyes return

IBM, the corporate based in 1911 as Computing-Tabulating-Recording Company, reached an 11-year high in March of $180 billion, simply 6% off an all-time document.

The corporate’s valuation has fallen round 14% since then to underneath $160 billion, but it surely stays 30% up on final 12 months.

IBM was as soon as a {hardware} firm, with mainframes and PCs the order of the day, however “Big Blue” segued right into a software and services company, which now makes up most of its revenue. IBM spun out its legacy infrastructure companies enterprise as a stand-alone entity referred to as Kyndryl in 2021.

IBM started its cloud journey in 2007 with Blue Cloud, persevering with by means of the years with the launch of IBM Cloud and thru milestone megabucks acquisitions equivalent to Purple Hat. In tandem, IBM has additionally pushed AI entrance and heart, beginning with IBM Watson and extra lately a slew of AI companies to assist AI demand within the enterprise — this included the launch of Watsonx, which helps corporations prepare, tweak, and deploy AI fashions.

“Consumer demand for AI is accelerating, and our guide of enterprise for Watsonx and generative AI roughly doubled from the third to the fourth quarter,” IBM chairman and CEO Arvind Krishna stated at its Q4 2023 earnings in January.

IBM’s current financials have been one thing of a blended bag, with its Q1 2024 numbers displaying a small income hike that missed analyst estimates and earnings that beat estimates. Then again, its consulting income fell barely.

Nevertheless, two months on, analysts are bullish about IBM’s path, with Goldman Sachs this week giving IBM a “purchase” ranking off the again of its AI investments and continued deal with infrastructure software program.

“We imagine that IBM is within the center innings of pivoting its portfolio to a set of modernized utility and infrastructure software program and a broader array of companies, away from a legacy-focused portfolio,” Goldman Sachs’ analyst James Schneider said.

It’s too early to say how this sentiment will age, however IBM’s AI investments are paying dividends so far as Wall Avenue is worried.

Legacy-building

SAP, Oracle, and IBM aren’t the one legacy software program corporations having fun with fruitful instances. Intuit, a 41-year-old monetary software program firm, hit the giddy heights of $187 billion final month, only a fraction under its Pandemic-era high of $196 billion. As with others, Intuit has been investing closely in AI as a part of its push to stay related, and this is the first thing it talks about at its earnings calls.

And Adobe, based in 1982, is also doing pretty well, with its valuation up 8% year-on-year to $236 billion — Adobe reported document Q1 and Q2 revenues with AI and cloud touted as pivotal to this growth.

Microsoft is the world’s most useful firm, a $3.3 trillion juggernaut whose shares have surged 33% previously 12 months. A decade within the scorching seat, Satya Nadella has remodeled Microsoft right into a cloud-first, AI-first colossal firm, having misplaced out on the smartphone gold rush attributable to prior missteps.

Microsoft turns 50 subsequent 12 months, and staying related after so many industrial, technological, political, and managerial shifts isn’t simple. However Microsoft hasn’t simply remained related — its revenues, income, and just about every other metric proceed to surge, due to its investments within the cloud and, extra lately, generative AI.

Whereas these corporations are positively benefiting from embracing new developments, there are different elements at play as nicely — particularly, buyers don’t have many locations to park their cash to make bets on new expertise.

Ray Wang, founder and principal analyst at Constellation Research, believes the lower of competitors in sure markets has helped drive buyers towards the biggies.

“There’s minimal competitors as we’re in oligopolies and duopolies,” Wang instructed TechCrunch. “We used to have tons of of software program corporations, however many years of mergers and acquisitions have whittled down the choices to a couple corporations in each geography, class, market dimension, and trade.”

Wang additionally pointed to the stagnant IPO market, in addition to the impression of the personal fairness sphere, as explanation why legacy expertise corporations are doing nicely.

“COVID killed the IPO market — we don’t have the startups of the previous that may develop to grow to be the subsequent Oracle, SAP, or Salesforce. The pipe has been dangerous regardless of the variety of software program corporations being began — they haven’t gotten to scale,” Wang stated. “[And] plenty of the acquisitions by the PE corporations have destroyed the spirt of entrepreneurship and [have] turned these corporations into monetary robots.”

There are numerous methods to slice and cube all this, however well-established software program corporations are in the end higher positioned to thrive when a game-changing expertise equivalent to AI comes alongside, owing to the actual fact they’ve a market presence and secure buyer base.

Their respective cloud transitions are additionally a giant a part of the narrative, tying in neatly with the rise of AI, which is closely depending on the cloud.

In addition they have vital sources at their disposal, with strategic acquisitions taking part in a serious half of their push to remain related: IBM is bolstering its hybrid cloud ambitions with its current $6.4 billion bid for HashiCorp, whereas SAP revealed plans to pay $1.5 billion for AI-infused digital adoption platform WalkMe.

AI may be having a minimal impression on corporations’ backside line in the present day, but it surely’s a must have so far as Wall Avenue is worried: Alphabet, Amazon, and Microsoft have all hit document highs of late, and AI is a major part of it. Apple’s shares also hit an all-time high off the again of its current AI bulletins, although “Apple Intelligence” isn’t obtainable but.

The AI tide may be lifting all boats at current, however Gartner’s famed “hype cycle” prophesizes that curiosity in new expertise wanes as all of the early experiments and implementations fail to ship on their promise — that is what it calls a “trough of disillusionment.” This might be coming, based on Lovelock, which means lots of these billion-dollar generative AI startups might have one thing to fret about.

“It’s simple to get misplaced in new and rising software program markets,” Lovelock stated. “Additionally it is onerous to compete for consideration when new AI corporations are boasting multi-billion {dollars} of income inside a number of years of launch. Nevertheless, conventional software program markets have a mixed annual income over $1 trillion in 2024 — legacy software program gross sales are rising strongly, and AI’s sturdy progress has obfuscated this truth for a lot of.”

Companies which have been round for many years are higher positioned to flourish attributable to their present foothold. We may be in an AI bubble, however when mainstream adoption really takes off, the SAPs, Oracles, and IBMs of the world will probably be higher positioned to leap on it.