Managing payroll is a vital side of any enterprise, particularly for the HR workforce, but it surely’s a process that may be each time-consuming and error-prone when achieved manually. Proper from getting into the wages of workers into the system to making use of the deduction within the last reconciliation, there are loads of duties and processes that require human consideration.

That is the explanation automation is essentially the most dependable strategy when managing substantial volumes of payroll knowledge. On this weblog, we’ll discover the payroll course of, its challenges, and the way automation can simplify it.

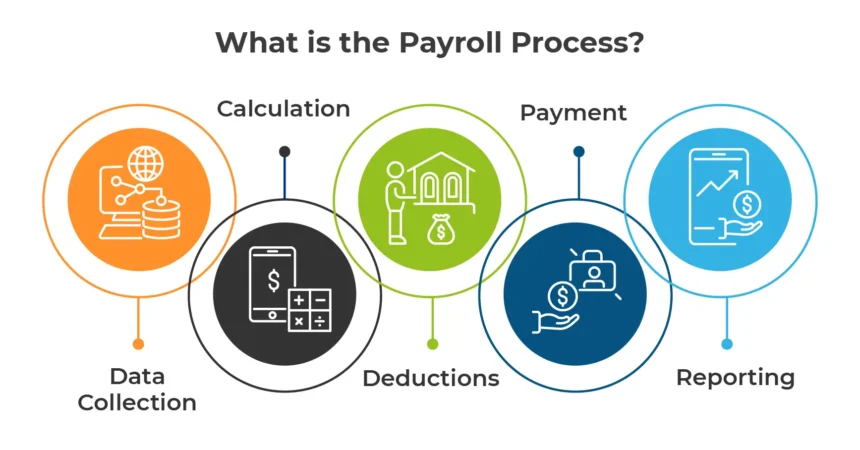

What’s the Payroll Course of?

Earlier than delving into the advantages of automation, let’s first perceive what the payroll course of entails:

-

Knowledge Assortment

This step entails gathering important worker data comparable to hours labored, extra time, deductions, and different compensation-related knowledge.

-

Calculation

After getting all the required knowledge, it is advisable calculate gross wages and account for hourly charges, salaried pay, bonuses, and different parts.

-

Deductions

This step contains withholding taxes, Social Safety contributions, retirement fund deductions, and different advantages and deductions to which workers are entitled.

-

Cost

That is the place you distribute workers’ internet pay by way of numerous strategies like direct deposit, checks, or different fee choices.

-

Reporting

Guaranteeing compliance with tax laws and offering workers with pay stubs and tax paperwork are essential elements of the method.

Performing these duties manually is time-consuming, resulting in errors like missed tax deductions and worker knowledge. Additionally, with handbook payroll administration, the danger of knowledge breaches additionally elevated. With these challenges within the payroll course of, it’s time to put automation within the entrance to speed up it.

Advantages of Utilizing Payroll Automation for Enterprise Course of

Automated payroll processing entails utilizing computerized techniques to handle and execute the payroll course of. Usually, it’s seamlessly built-in with the corporate’s Enterprise Useful resource Planning (ERP) system.

This automated course of within the HR automation not solely handles recording worker wage data, computing deductions, and producing stories for tax authorities but in addition streamlines the administration of worker advantages. It additionally contributes to improved buyer relationship administration and smoother accounting procedures throughout the group. Among the payroll automation advantages are-

-

Simpler Wage Calculation

You not have to take care of piles of handbook paperwork every month to kickstart the payroll course of. Take into consideration the hours devoted to accumulating knowledge, crunching fee numbers, managing deductions, distributing checks, and presumably sharing knowledge with third-party distributors.

With payroll automation, you not solely save time but in addition cut back the hassle wanted to prepare and execute the payroll cycle. The system takes care of most duties, from calculations to automated fee transfers. Your major position is to make sure that the entered payroll knowledge is correct.

-

Improved Time Administration

Conventional payroll techniques contain handbook calculations of hourly wages and time clock knowledge, which might be an uphill process. Automation simplifies the method by effortlessly integrating time clock knowledge into the payroll system, guaranteeing well timed and correct funds. This automated technique eliminates the potential for errors related to handbook interventions.

-

Sooner Tax Administration

The method of tax calculation is essential however usually tedious and susceptible to errors. It entails computing a wide range of taxes, comparable to state, federal, medicare, and social safety, every ruled by distinct formulation and inclusion guidelines.

With the usage of an automatic system, preconfigured tax fee codes take cost of gathering pertinent knowledge and executing the calculations. This ensures precision and punctuality in worker payouts and ensures correct tax reporting to the authorities.

-

Price Saving

Excessive quantity handbook effort is required to carry out knowledge extraction, enter knowledge into the system, and course of it additional for payroll. Utilizing an automation system reduces the handbook labor requirement, which reduces the operational value of payroll administration in HR automation.

-

Provide Sturdy Knowledge Safety

Handbook payroll techniques lack strong security measures. Furthermore, these techniques usually depend on unsecured e-mail communications for sharing financial institution particulars and delicate payroll knowledge. Bodily copies of payroll data additionally current safety vulnerabilities.

In distinction to conventional submitting cupboards, an automatic payroll workflow employs cutting-edge safety measures. This encompasses numerous safety layers, comparable to one-time passwords (OTPs), two-factor authentication, and encryption, guaranteeing the confidentiality of your payroll data.

A contemporary payroll system transmits all knowledge by way of safe, encrypted channels. Usually, payroll data is securely saved on networks with encryption, providing the utmost safety and peace of thoughts.