AI mortgage startup LoanSnap is dealing with an avalanche of lawsuits from collectors and has been evicted from its headquarters in Southern California, leaving staff fearful in regards to the firm’s future, TechCrunch has discovered.

LoanSnap, based by serial entrepreneurs Karl Jacob and Allan Carroll, has raised round $100 million in funding since its 2017 seed spherical, $90 million of which was raised between 2021 and 2023, in response to PitchBook. Traders embrace Richard Branson’s Virgin Group, the Chainsmokers’ Mantis Ventures, Baseline Ventures, and Reid Hoffman, LoanSnap says. The startup additionally took on round $12 million in debt, PitchBook estimates.

Regardless of the capital it raised, since December 2022, LoanSnap has been sued by at the least seven collectors, together with Wells Fargo, who collectively alleged the startup owes them greater than $2 million. LoanSnap has additionally been fined by state and federal companies and practically misplaced its license to function in Connecticut, in response to authorized paperwork obtained by TechCrunch.

Whereas LoanSnap has not but shut down, in response to two staff, the vibe inside the corporate is harrowing as staff look ahead to readability on the corporate’s future. Between December 2023 and at the least January 2024, the corporate missed payroll and headcount has dwindled. At its excessive level, LoanSnap employed greater than 100. After layoffs and attrition, that quantity has diminished to lower than 50, in response to a supply.

“The present state is a results of horrible management, overspending on futility, and institutional buyers falling for the charming facade that Karl can present,” one former worker, who requested to stay nameless resulting from worry of retaliation, advised TechCrunch. The particular person’s id is thought to TechCrunch.

Given the scope of the corporate’s issues starting in 2021, the scenario begs the query of why buyers poured cash into the corporate as late as 2023 — and what’s going to occur subsequent.

Reid Hoffman was not obtainable for remark, and his workplace declined remark. (LoanSnap just isn’t a Greylock Companions funding, the VC agency confirmed). Virgin Group, Mantis VC, and Baseline Ventures additionally didn’t reply to requests for remark.

Jacob and Carroll, who’re LoanSnap’s CEO and CTO, respectively, didn’t reply to a number of requests for feedback over a number of days, by way of e-mail and texts. LoanSnap’s press line deferred to the CEO within the matter and declined to supply remark.

Collectors sue, companies fantastic LoanSnap

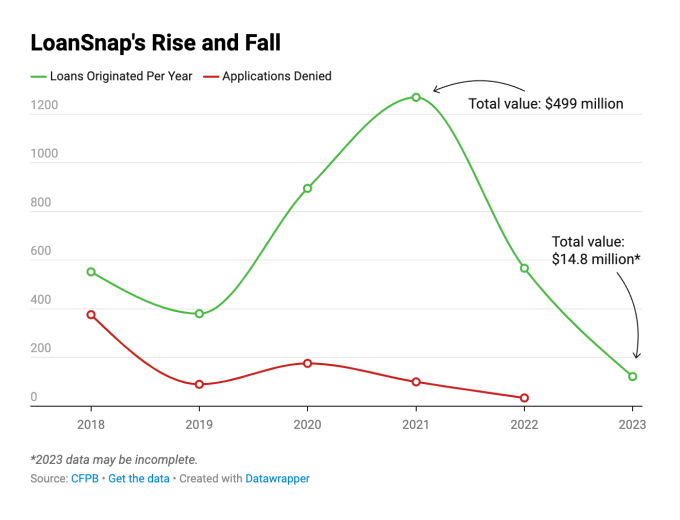

In 2021, LoanSnap originated practically 1,300 loans for a complete worth of virtually $500 million, in response to data filed with federal regulators — each information for the startup. By 2023, LoanSnap reported to the Client Monetary Safety Bureau (CFPB) that it had originated solely 122 loans for the yr (although the info will not be last).

Regardless of the document variety of loans, bother was already brewing in 2021. Authorized paperwork present that in Might 2021, the identical month LoanSnap introduced its $30 million Series B with buyers like Hoffman, the U.S. Division of Housing and City Growth Mortgagee Evaluate Board entered right into a settlement agreement with the corporate. Whereas LoanSnap didn’t admit to wrongdoing, the company alleged that it violated Federal Housing Administration (FHA) necessities for failing to inform the FHA of an working loss that exceeded 20% of its fiscal 2019 quarter-end web price. It agreed to pay a $25,000 fantastic.

Since 2021, at the least three complaints have been filed towards LoanSnap with the Higher Enterprise Bureau, and the corporate now has an F ranking. These complaints allege that the startup charged non-refundable charges after which failed to shut on loans in a well timed method or didn’t pay taxes from an escrow account. Moreover, in 4 complaints filed to the Client Monetary Safety Bureau and reviewed by TechCrunch, shoppers accused LoanSnap of promoting a paid-in-full mortgage to a different lender as an alternative of correctly closing it out, deceptive shoppers about mortgage approvals and shorting escrow accounts.

Between December 2022 and Might 2024, at the least seven collectors sued LoanSnap, and the corporate went by way of at the least three CFOs, a supply says. Close to the top of 2022, Baseline Ventures’ Steve Anderson stepped down from the board, in response to somebody accustomed to the matter.

4 of the lawsuits have been from distributors claiming that the startup had fallen behind or fully stopped making contractual funds for providers. LoanSnap has not but filed a proper response with the courts for any of those fits, in response to public information.

For example, Wells Fargo filed a lawsuit in August 2023 for $431,000, alleging a mortgage it purchased from LoanSnap violated the financial institution’s income-to-debt-ratio insurance policies. As a result of LoanSnap defaulted on the lawsuit (that means it failed to reply in a well timed method), the decide ordered LoanSnap to pay.

In mid-2023, LoanSnap was dealing with a California Division of Monetary Safety and Innovation investigation stemming from a grievance filed towards it, and the corporate was keeping off threatened litigation from at the least one investor, in response to information considered by TechCrunch. (A spokesperson for the California Division of Monetary Safety stated it “doesn’t touch upon investigations even to verify or deny their existence.”)

Then, 2024 introduced extra authorized troubles. In January, Connecticut’s Division of Banking alleged the corporate was partaking in “systemic unlicensed mortgage mortgage” exercise by using unlicensed individuals. One worker advised TechCrunch that the corporate was keen to rent these with out a lot mortgage expertise, with the concept of coaching them so they may at some point get licenses.

Connecticut additionally claimed that LoanSnap violated the Truthful Credit score Reporting Act, the SAFE Act, and the Truthful Lending Act, amongst different state statutes, and threatened to revoke its license. Finally, LoanSnap paid a $75,000 fine with out admitting fault and promised to not use unlicensed individuals for mortgage mortgage officer work within the state.

“It’s a extremely large deal for them to threaten that,” stated Andrew Narod, a accomplice within the Banking and Monetary Companies Follow Group on the legislation agency Bradley. However Narod famous that the settlement wasn’t “significantly onerous,” including, “Pay $75,000 and cease doing unlawful issues, which, candidly, actually ought to have been the enterprise mannequin from the beginning.”

In February, LoanSnap was sued by its Costa Mesa landlord, who alleged the corporate stopped paying lease and owed practically $405,000. When LoanSnap didn’t reply the go well with, the decide dominated that it defaulted on the grievance, and the owner was given the OK to evict LoanSnap in mid-Might, in response to court docket filings. (LoanSnap had a second workplace in San Francisco, although it’s unclear if that workplace continues to be in use.)

In Might, a brand new go well with was filed. A tax firm that loaned LoanSnap $5 million alleges that LoanSnap stopped making funds and owes greater than $900,000.

One other VC invests tens of millions in 2023

Many of those lawsuits have been filed in late 2023. However even earlier than then, inside issues have been clear: LoanSnap’s funds had seen bother, in response to the FHA settlement; it had gone by way of layoffs; complaints had been filed to the BBB and the CFPB; and a identified Silicon VC had, inside sources say, resigned from the board.

Nonetheless, in July 2023, LoanSnap raised one other $19 million in enterprise funding from new investor Forté Ventures. (Forté Ventures didn’t reply to a request for remark).

One worker attributes the corporate’s enterprise fundraising success to CEO Jacob.

Jacob has the sort of résumé that pulls Valley VCs, having based and exited a number of startups since 1997, when he bought an organization known as Dimension X to Microsoft. His LoanSnap bio proudly says he’s “raised 23 rounds of financing” and “generated a whole bunch of tens of millions of {dollars} in investor returns.” His co-founder Carroll has additionally had repeat successes. He’s a former Microsoft analysis engineer who launched three earlier startups and bought two of them.

However many questions stay, akin to the place all of the tens of millions that LoanSnap raised went. The workers we spoke to don’t have solutions. When occasions have been good in 2021, and headcount was at its highest, Jacob engaged in expenditures like authorizing an costly open-bar vacation social gathering for workers in 2021 at a beachside resort. One yr, he gifted staff with Meta Portals and hosted a celebration in Denver for the Web3 ETH occasion.

The corporate was additionally working two places of work, each in dear rental areas. The lease in Costa Mesa (from which it was evicted) was round $55,000 a month, and the workplace in San Francisco charged at the least $30,000 a month lease, in response to court docket paperwork obtained by TechCrunch.

Staff have been advised that the multimillion-dollar Newport Seaside city home the place Jacob and Carroll stayed when visiting the Costa Mesa workplace was additionally owned by the corporate. LoanSnap hosted its 2022 vacation social gathering there.

Regardless of all the now-obvious issues, LoanSnap continues to be incomes public accolades from buyers, the media, and business gamers.

In mid-Might, Newsweek named LoanSnap amongst its listing of America’s Finest On-line Lenders, and certainly one of its VCs, True Ventures, applauded the startup on LinkedIn for the inclusion. That very same month, LoanSnap and Visa announced that LoanSnap had joined Visa’s fintech program, which helps startups use its fee applications.

And simply final month, LoanSnap announced it entered into Nvidia’s free Inception program, which supplies advantages to AI startups. One former worker known as these latest bulletins odd, as the corporate seems to be making an attempt to both pivot or transfer on as if nothing is mistaken.

“It’s actually not exhausting to search out quite a few lawsuits and complaints, a few of them from governmental companies, with a fast Google search,” the worker stated, questioning how Nvidia and Visa let LoanSnap into the applications.

True Ventures and Visa didn’t reply to our request for remark. Nvidia declined to remark.

In the meantime, staff who haven’t but give up really feel caught, uncertain if some model of the corporate will come up from the ashes.

“There’s no communication, no accountability,” the worker stated. “That makes individuals nervous.”