The combination of Synthetic Intelligence (AI) applied sciences throughout the finance business has totally transitioned from experimental to indispensable. Initially, AI’s position in finance was restricted to fundamental computational duties. With developments in machine studying (ML) and deep studying (DL), AI has begun to considerably affect monetary operations.

Arguably, probably the most pivotal breakthroughs is the appliance of Convolutional Neural Networks (CNNs) to monetary processes. This drastically enhanced the capabilities of pc imaginative and prescient methods to acknowledge patterns far past the aptitude of people.

On this article, we current 7 key functions of pc imaginative and prescient in finance:

No.1: Fraud Detection and Prevention

No.2: Automated Doc Evaluation and Processing

No.3: Buyer Identification and Biometric Authentication

No.4: Algorithmic Buying and selling and Market Evaluation

No.5: Credit score Threat Evaluation and Administration

No.6: Regulatory Compliance and Surveillance

No.7: Improvements in Buyer Service and Expertise

About us: Viso Suite permits corporations to handle all the ML lifecycle in a single, easy-to-use interface. By controlling all the lifecycle, ML groups not have to depend on level options to fill within the gaps. To study extra about Viso Suite, guide a demo with our group.

Pc Imaginative and prescient Algorithms for Finance

Fashions like YOLO (You Solely Look As soon as) fashions and Quicker R-CNN have set benchmarks in real-time processing as effectively. Close to-instantaneous speeds are essential for fraud detection and high-frequency buying and selling.

Concurrently, applied sciences like TensorFlow and PyTorch have develop into cornerstones of creating and deploying complicated modes. That is largely due to their capability to investigate huge arrays of monetary knowledge from market traits to buyer conduct.

Different important contributions embrace works by Andrew Ng. This pc scientist and expertise entrepreneur has extensively researched AI and machine studying’s impression on finance. He continues to play a number one position in showcasing fashions that may predict market adjustments with unprecedented accuracy.

Moreover, the introduction of GANs (Generative Adversarial Networks) has accelerated AI adoption. These function the best framework for classy simulations of monetary eventualities for danger evaluation and decision-making.

These technological breakthroughs are persevering with to rework how monetary establishments function. By providing unprecedented speeds and scalability to derive insights and patterns from knowledge, they’re quick turning into indispensable. Under, we’ll discover among the profitable outcomes of how these AI instruments for finance are revolutionizing the business.

Purposes of Pc Imaginative and prescient in Finance

No. 1: Fraud Detection and Prevention

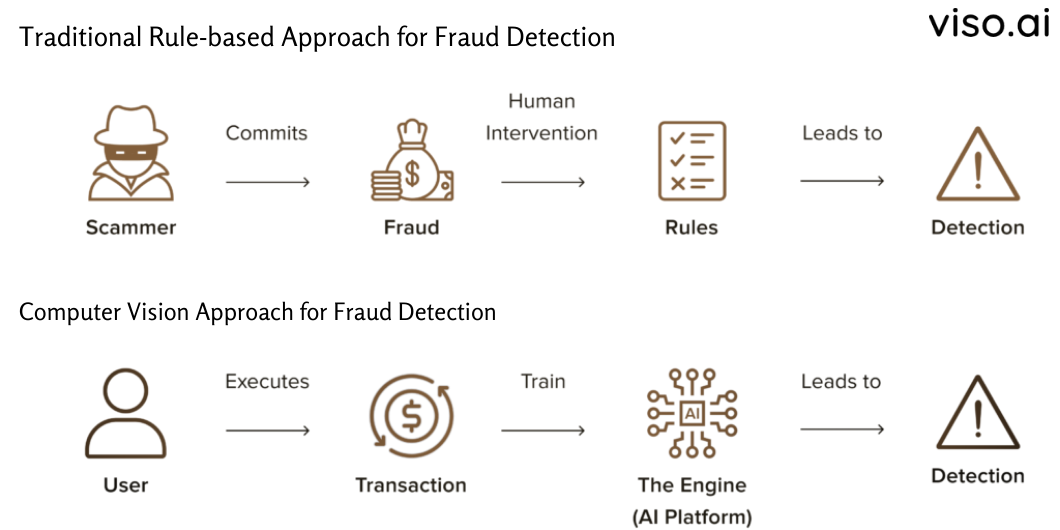

AI-powered fraud detection methods use machine studying algorithms to detect patterns and anomalies that will point out fraud. These methods course of huge datasets in real-time, figuring out irregularities in transactions and consumer behaviors.

Establishments broadly use machine studying fashions like Random Forest, neural networks, and anomaly detection algorithms. TensorFlow and PyTorch are among the many hottest frameworks for creating and deploying these options.

For example, PayPal makes use of deep studying to investigate a big selection of information to identify fraudulent transactions extra precisely. One other notable case examine is Mastercard’s deployment of Choice Intelligence, a complete fraud detection instrument. It leverages AI to evaluate the transaction context and buyer’s profile to gauge the danger of fraud. Its preliminary modeling exhibits an elevated detection charge of 20% and as much as 300% in some instances.

No. 2: Automated Doc Evaluation and Processing

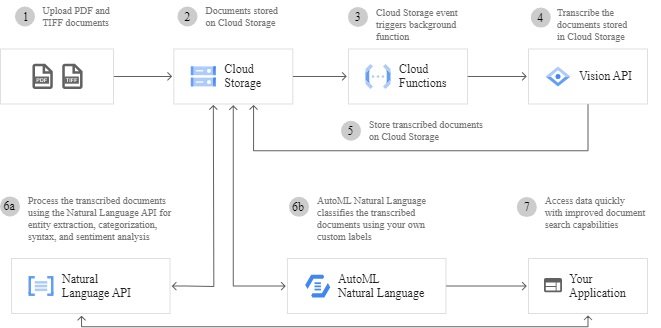

Pc imaginative and prescient can automate the extraction, evaluation, and validation of doc info. This has the potential to revolutionize many processes by accelerating processing instances whereas bettering accuracy and safety.

Actual-world functions vary from automating mortgage approvals to processing insurance coverage claims. Applied sciences reminiscent of Optical Character Recognition (OCR) and Pure Language Processing (NLP) are foundational to this.

Google Cloud Vision API and Tesseract are outstanding OCR instruments for changing photos of textual content into machine-readable knowledge. Alternatively, NLP frameworks like BERT assist in understanding the context and content material of paperwork.

JPMorgan Chase’s COiN platform is one instance of this method in motion. It makes use of machine studying to evaluate and interpret business mortgage agreements. It’s reportedly accountable for decreasing doc evaluate time from 360,000 hours to seconds. This effectivity not solely brings down operational prices but additionally enhances decision-making and buyer experiences.

No. 3: Buyer Identification and Biometric Authentication

Biometric safety has develop into a cornerstone within the finance business, providing a sturdy mechanism for safe buyer identification. Monetary establishments now routinely deploy fingerprint scanning, facial recognition, and voice identification to supply safe and handy consumer entry.

Use instances span from cellular and on-line banking apps utilizing fingerprints and facial recognition to ATMs with voice verification. These methods depend on AI fashions, like CNNs, for picture recognition and recurrent neural networks (RNNs) for voice sample evaluation. In flip, these fashions are sometimes developed utilizing frameworks like TensorFlow and Keras.

An illustrative case examine is HSBC’s use of voice recognition to confirm buyer identities. Voice ID drastically reduces the time spent on buyer authentication, typically a irritating a part of the phone help expertise. Equally, Wells Fargo and lots of different banks use a number of modalities for biometric authentication on their cellular apps.

No. 4: Algorithmic Buying and selling and Market Evaluation

Pc imaginative and prescient’s position in monetary markets consists of visible knowledge evaluation and interpretation. It permits merchants to assimilate and act upon complicated market indicators swiftly. Utilizing deep studying fashions, reminiscent of Lengthy Quick-Time period Reminiscence (LSTM) networks, companies analyze time-series knowledge for predictive insights. This makes algorithmic buying and selling methods that may adapt to market dynamics in real-time attainable.

These methods leverage frameworks like Keras and PyTorch for his or her capability to deal with sequential knowledge to know market traits. AI’s advantages prolong to processing unstructured knowledge from information feeds and social media. For instance, combining pc imaginative and prescient for sentiment evaluation throughout monetary occasions with NLP to gauge market sentiment and inform buying and selling selections.

No. 5: Credit score Threat Evaluation and Administration

AI’s predictive evaluation capabilities are redefining credit score scoring as effectively. Machine studying can analyze credit score danger through the use of huge quantities of information, even from non-traditional sources. These algorithms can predict mortgage defaults extra precisely, aiding lenders in making extra data-driven credit score selections.

Pc imaginative and prescient can extract and analyze knowledge from paperwork that conventional methods may overlook. It makes use of neural networks and determination timber for a complete method to danger analysis.

ZestFinance’s Zest Automated Machine Studying (ZAML) platform is a cutting-edge credit score danger administration expertise. It permits extra exact danger assessments by analyzing hundreds of information factors. Ant Monetary takes the same method to its Sesame Credit score scoring system. It combines transaction knowledge with public information to evaluate creditworthiness within the absence of conventional credit score histories.

Reports by the Federal Reserve have proven that machine-learning fashions can considerably outperform conventional credit score scoring strategies. These developments enable for not solely quicker but additionally extra equitable credit score selections, increasing market entry to beforehand underserved populations.

No. 6: Regulatory Compliance and Surveillance

AI has develop into a significant instrument for guaranteeing regulatory compliance within the finance sector. Its capability to observe transactions for indicators of cash laundering, insider buying and selling, and different illicit actions is indispensable. Machine studying fashions, like Assist Vector Machines (SVMs) and Neural Networks, can detect patterns and anomalies in huge datasets. Their accuracy and scalability make them able to detections that human auditors are prone to miss.

In transaction surveillance, pc imaginative and prescient methods can monitor and analyze complicated buying and selling patterns and visible knowledge. They’ll then flag uncommon actions for additional evaluate by human auditors. These methods typically depend on anomaly detection algorithms carried out utilizing frameworks like TensorFlow and Apache Kafka.

Applied sciences like anomaly detection algorithms, carried out through platforms reminiscent of TensorFlow and Apache Kafka, are key to those surveillance methods.

Danske Financial institution’s adoption of anti-money laundering (AML) to fight monetary crime is one instance. They carried out an AI platform that screens transactions and buyer conduct in accordance with their compliance framework. This has markedly improved Danske Financial institution’s capability to detect potential compliance breaches and take preemptive motion.

No. 7: Improvements in Buyer Service and Expertise

AI chatbots and digital assistants in finance might considerably improve consumer experiences by offering fast, customized, and environment friendly responses. These AI instruments use NLP and ML strategies to have interaction with clients, reply queries, and even present monetary recommendation.

As an illustration, Financial institution of America’s chatbot, Erica, employs predictive analytics and cognitive messaging to ship monetary steerage to clients. Erica can help with easy transactions, present credit score report updates, and provide proactive strategies for private finance administration. It has already surpassed 1.5 billion buyer interactions and will solely enhance with time.

One other instance is Capital One’s digital assistant, Eno. This AI assistant can reply questions, spot fraud, observe spending, and handle playing cards and accounts. Each of those methods make the most of a chat-like conversational interface to deal with all of those client interactions.

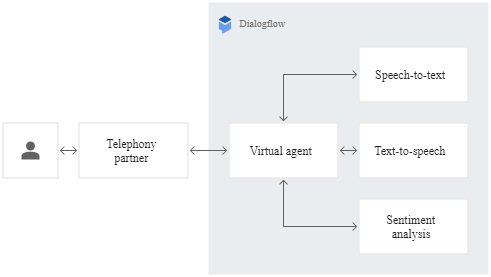

Many of those AI-powered instruments make the most of frameworks like Google’s Dialogflow or IBM Watson. These methods assist scale significant buyer interactions with decrease ready instances whereas decreasing ticket masses.

Future Tendencies: AI and Pc Imaginative and prescient in Finance

The frontier of monetary AI is essentially propelled by predictive analytics. This expertise is turning into more and more indispensable for bettering decision-making and future-proofing monetary methods. New paradigms, like Reinforcement Studying and Quantum Computing, will additional improve and refine predictive fashions.

Some rising applied sciences and potential functions to be careful for embrace:

- Federated studying for privacy-preserving knowledge evaluation.

- Blockchain-integrated AI for safe, decentralized transaction ledgers.

- Quantum-enhanced algorithms for complicated monetary modeling.

Goldman Sachs, for instance, is already exploring quantum computing to hurry up numerous time-consuming monetary operations. We’re additionally already witnessing the rise of AI-driven hedge funds like Renaissance Applied sciences. These companies use superior mathematical fashions to take advantage of present market inefficiencies.

Nevertheless, the implementation of pc imaginative and prescient and AI within the monetary providers business is just not with out its challenges. Among the important obstacles that future AI instruments for finance might want to overcome are:

- Guaranteeing sturdy knowledge privateness and safety amidst stringent rules.

- Overcoming the ‘black field’ nature of AI for clear and explainable AI methods.

- Balancing AI innovation with moral issues to stop biases in automated selections.

We’re seeing some present frameworks deal with a few of these points, like TensorFlow Quantum and IBM’s Watson OpenScale. They deal with these challenges by offering the groundwork for clear and moral AI functions in finance.

Extra Pc Imaginative and prescient Purposes

To study in regards to the applicability of pc imaginative and prescient throughout industries, try our different blogs: